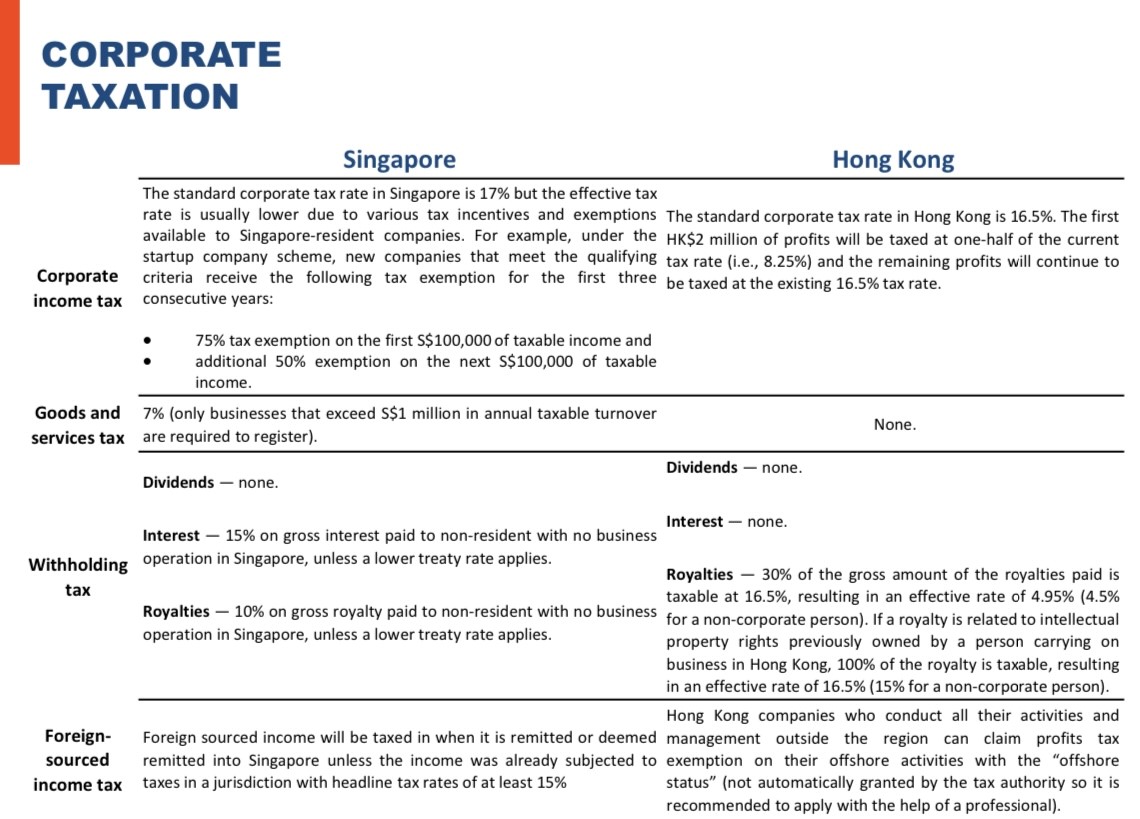

Taxes are on top of the agenda for any entrepreneur and one of the key considerations for setting up a business in a given jurisdiction. Singapore and Hong Kong have been competing for decades to gain dominance as Asia’s ‘Best Place to Do Business’. Both the regions have been luring foreign investors with their tax friendly policies but which one has the most competitive tax regulation ? Please find below a tax comparison between these two jurisdictions.

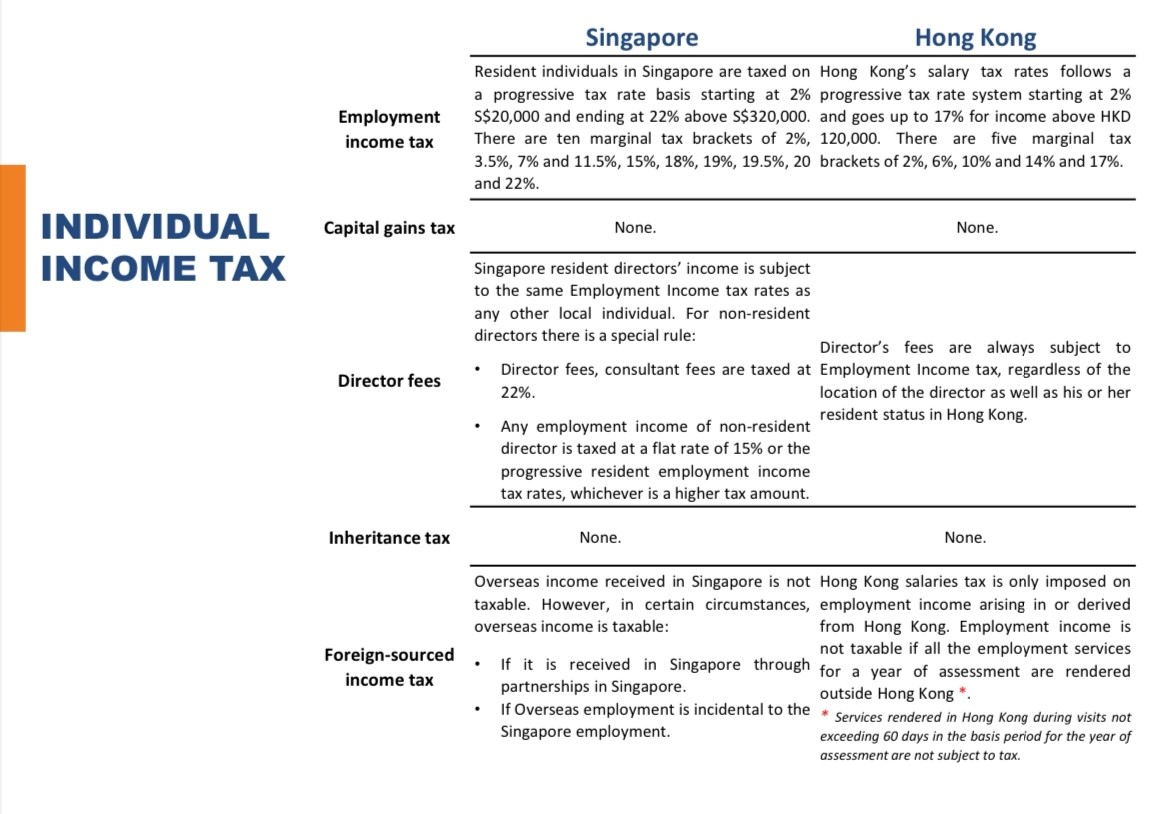

Personal income tax follows a tiered system in both cities : in Singapore the personal income tax rate begins at 2 going up to 22 for higher earners, while in Hong Kong salary tax begins at 2 and goes up to 17 for higher earners.

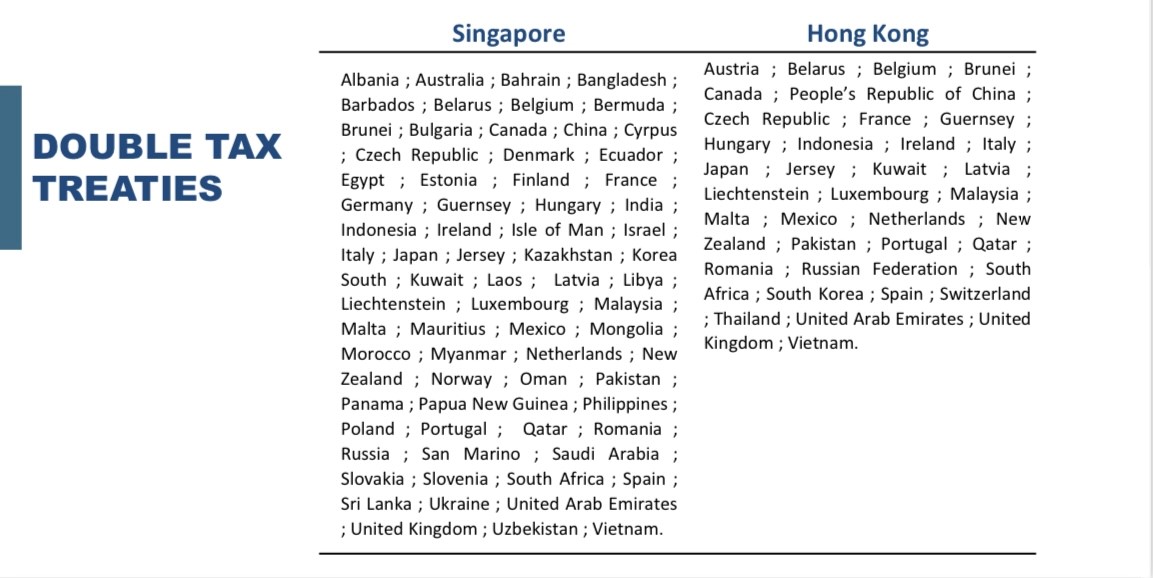

When determining whether Hong Kong or Singapore is a more appropriate jurisdiction, foreign enterprises should also consider the relevant Double Tax Treaties (“ DTTs”) (also referred to as Double Taxation Agreements or “ in Singapore) each have country has entered into Singapore, which has ratified ninety 90 comprehensive DTTs, currently offers far more options than Hong Kong, which has only ratified forty five 45 comprehensive DTTs to date However, both countries have recently increased the number of DTTs they have, and this trend looks to continue for both Hong Kong and Singapore in the near future.

Whether you choose Singapore or Hong Kong, both are great options to set up your business. Interested in setting up your investment vehicle or regional base in Singapore or Hong Kong? Please do not hesitate to contact our dedicated teams. Orbis Alliance has helped numerous companies around the globe. We can help you set up your company in Singapore or Hong Kong hassle free, so please do not hesitate to contact us at contact@orbis alliance.com.

Français

Français

English

English  Español

Español